Category: Finance

-

N-days Close and Low + Buy on % Dip indicator on TradingView

Script to check for a n% dip in the last N days

-

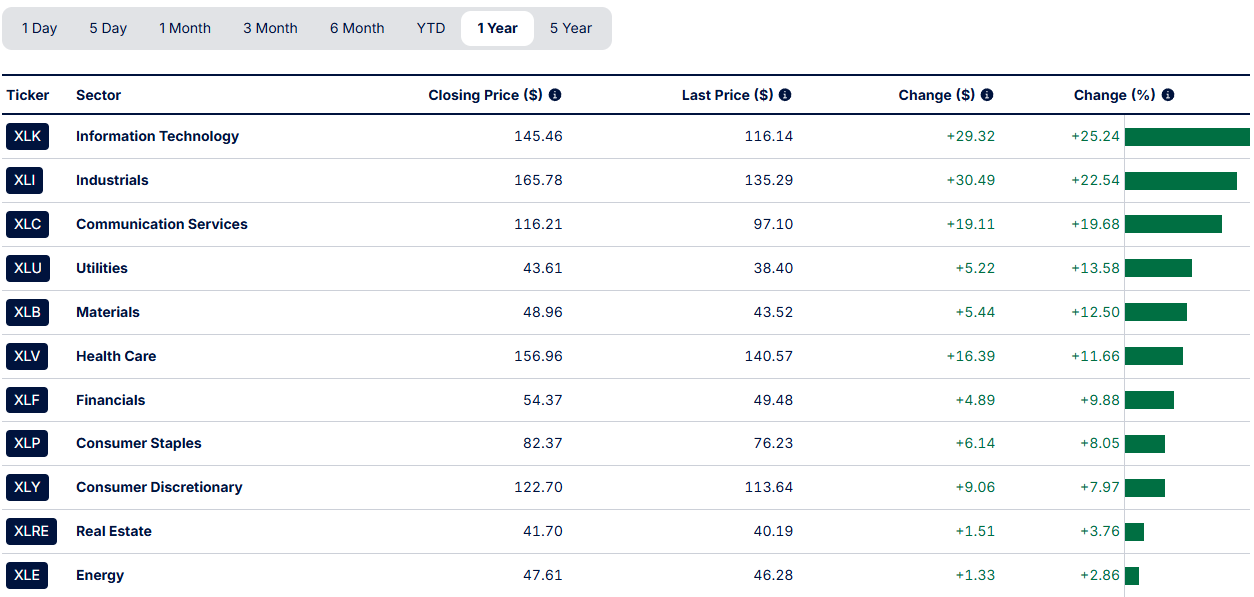

“Trade the Trend” Strategy – Summary

Detailed summary of an 11‑month dollar‑cost averaging experiment using “Trade the Trend” strategy into the 11 Sector SPDR ETFs conducted throughout 2025, covering the total amount invested, cost basis and unrealized performance.

-

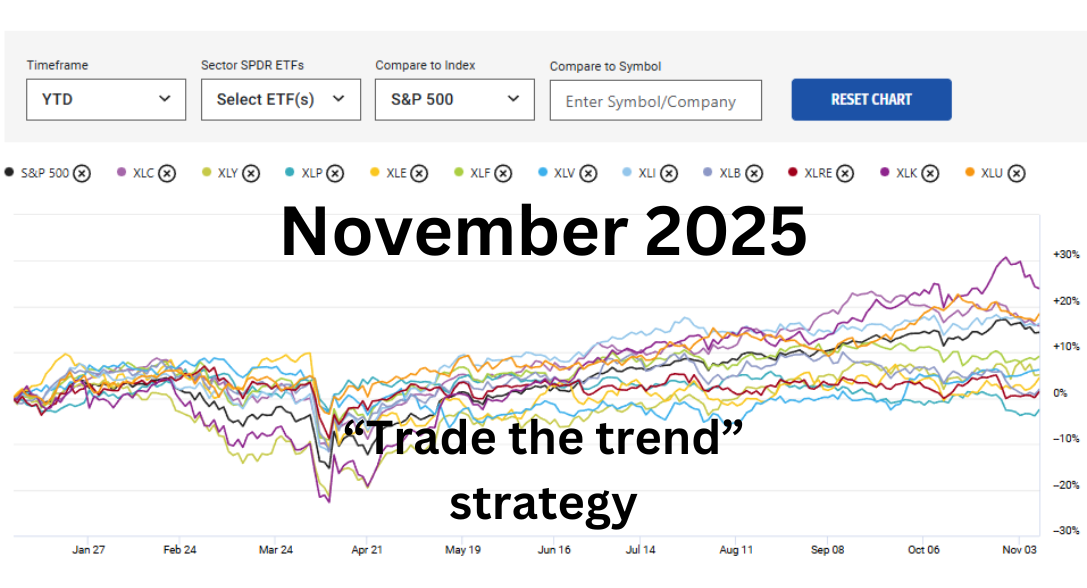

“Trade the Trend” Strategy – November 2025 update

October 2025 was mixed for SPDR ETFs. Technology surged (+6.58%), but most sectors posted modest or negative returns. The S&P 500 ended slightly higher, reflecting cautious optimism amid uneven performance and subdued investor sentiment.

-

“Trade the Trend” Strategy – October 2025 update

September 2026 was a strong month for the U.S. stock market. The S&P 500 reached new highs, driven by solid corporate earnings and growing hopes for interest rate cuts. Despite ongoing inflation and unemployment concerns, investor sentiment remained positive. Technology led sector gains, followed by Communication Services.

-

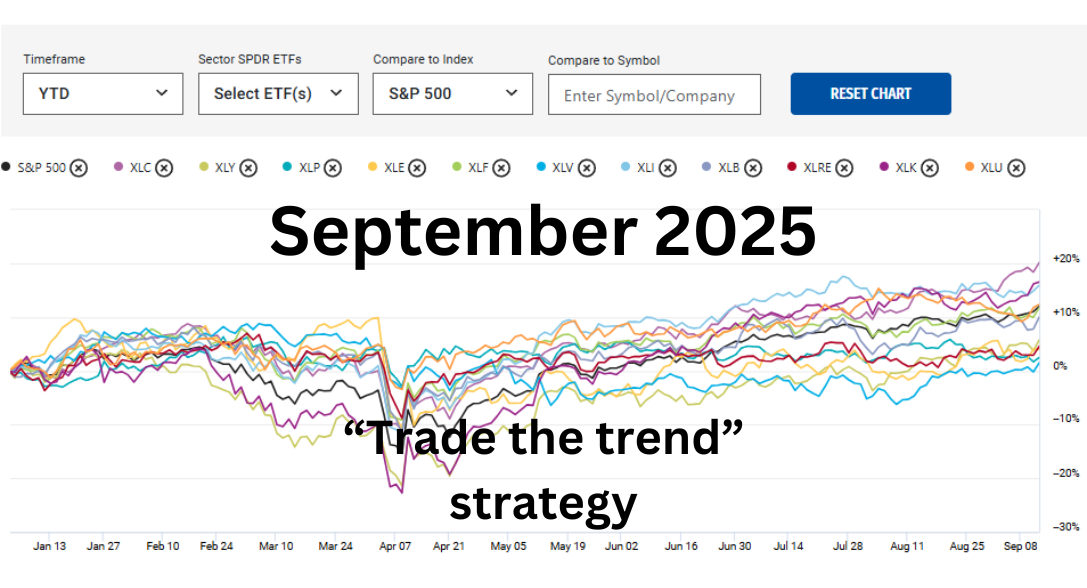

“Trade the Trend” Strategy – September 2025 update

August 2025 kept the momentum alive for U.S. markets, with the S&P 500 climbing to fresh record highs amid growing optimism over potential rate cuts. Early gains were fueled by solid corporate earnings and a revised GDP estimate that beat expectations. However, investor sentiment remained sensitive to mixed labor data and persistent inflation concerns. The…

-

“Trade the Trend” Strategy – August 2025 update

July 2025 delivered a mixed bag for U.S. markets. The S&P 500 initially extended its summer rally, buoyed by strong earnings from tech giants and easing inflation data. However, sentiment turned cautious mid-month as new tariff announcements and weaker-than-expected jobs data triggered a pullback. Despite volatility, sector rotation remained active, with energy and utilities outperforming…

-

“Trade the Trend” Strategy – July 2025 update

June 2025 saw U.S. markets extend their rally, with the S&P 500 climbing to a new record high. Gains were driven by strong tech performance, easing trade tensions, and robust corporate earnings, capping off the best quarter for equities in over a year.

-

“Trade the Trend” Strategy – June 2025 update

May 2025 saw U.S. markets rebound as investor confidence improved. The S&P 500 surged early in the month, buoyed by easing trade tensions and strong corporate earnings, before settling at a 6.3% gain—its best May performance in decades.

-

“Trade the Trend” Strategy – May 2025 update

April 2025 saw U.S. markets grapple with volatility amid shifting tariff policies and uncertain economic signals. Early drops in the S&P 500 gave way to a modest recovery as investors weighed evolving trade negotiations and mixed inflation data. The Federal Reserve maintained steady interest rates, while defensive sectors outperformed energy and financials. Overall, market sentiment…

-

“Trade the Trend” Strategy – April 2025 update

March 2025 saw U.S. markets navigating a complex landscape shaped by ongoing economic and geopolitical challenges. While defensive sectors maintained stability, growth-oriented areas continued to face headwinds. The Federal Reserve’s decision to hold interest rates steady reflected cautious optimism, though inflationary pressures and trade uncertainties remained key concerns. Additionally, the back-and-forth implementation of tariffs created…